The Bitcoin ETF token (BTCETF) is a new crypto rapidly gaining popularity, primarily due to the excitement surrounding the launch of the first ‘Spot Bitcoin Exchange-Traded Fund (ETF).’

BTCETF’s charm lies in its speculative framework, allowing investors to make predictions regarding the Bitcoin ETF’s launch. Additionally, its high staking rewards and dynamic token burn mechanism can help the token grow and sustain its long-term value.

In its recently launched presale, BTCETF raised over $1.8 million in just three weeks, showing high investor trust and confidence. This article provides a detailed overview of the platform, including a complete step-by-step guide on how to buy Bitcoin ETF tokens.

Overview of the Bitcoin ETF Token Presale

- Dynamic Tokenomics: The Bitcoin ETF Token is an innovative crypto linked to the progress of Bitcoin Spot ETFs. It incorporates a deflationary model, where 25% of the total supply will be burned through milestone events, improving its scarcity and potential value.

- Presale Success: The presale has seen high investor traction, raising over $1.8 million within its initial weeks, reflecting strong market interest and community trust.

- Staking Rewards: $BTCETF offers an attractive staking mechanism, with early stakers enjoying high Annual Percentage Yields (APY), currently over 135%.

- Token Availability: During the ongoing fifth stage of the presale, tokens are available at $0.0058 each. The presale is structured over ten stages, with a progressive pricing strategy to incentivize early participation and boost the token’s valuation over time.

How to Buy Bitcoin ETF Token (BTCETF) – A Complete Five-Step Guide

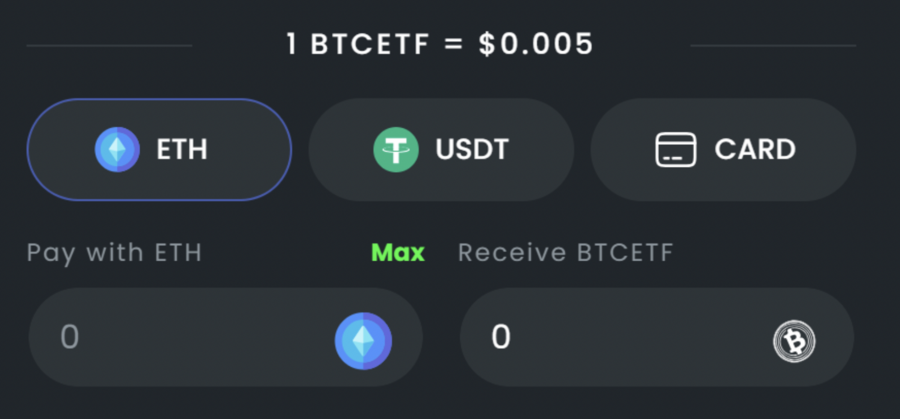

Bitcoin ETF Token is among the most promising new cryptos, especially during its ongoing presale phase. The presale is an exciting time for investors to buy $BTCETF using various cryptos, including Ethereum, Tether, Binance Coin, MATIC, or a credit card.

Here’s a complete step-by-step guide to buying $BTCETF;

Step 1: Installing a Crypto Wallet

Before purchasing $BTCETF, investors need a compatible ERC-20 wallet. MetaMask is highly recommended because of its security and availability on mobile devices and web browsers.

Visit the MetaMask website to download the wallet, create a strong password, and securely store the provided seed phrase for wallet recovery.

Step 2: Buy ETH/USDT/BNB/MATIC

To participate in the presale, investors must have ETH or USDT, which are interchangeable for $BTCETF. These can be purchased from centralized crypto exchanges like Binance or Coinbase using several payment methods, including debit/credit cards or bank transfers.

After purchase, transfer these tokens to your MetaMask wallet. While MATIC and BNB can also be used to get BTCETF, tokens bought with these cryptos are not eligible for early staking rewards.

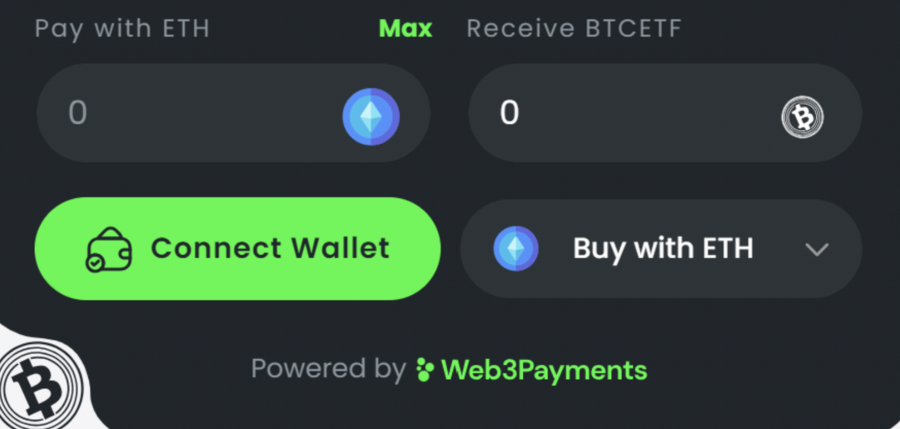

Step 3: Connect to the Bitcoin ETF Token Presale

Visit the Bitcoin ETF Token presale site and select ‘Connect Wallet.’ Choose MetaMask or your desired wallet, and then follow the instructions to authorize the connection between your wallet and the presale platform.

Step 4: Purchasing $BTCETF Tokens

Next, enter the number of Bitcoin ETF tokens you want to buy on the presale site. After considering the blockchain transaction fees, the platform will calculate the equivalent amount in $BTCETF. Confirm your purchase by clicking ‘Buy $BTCETF Tokens.’

Step 5: Claim Your $BTCETF Tokens

Tokens bought during the presale are not instantly available. They will be released to investors after a token generation event that follows the end of the presale. Buyers can come back to the Bitcoin ETF Token presale site and hit ‘Claim Tokens.’

For updates about the presale, you can join the Bitcoin ETF Token Telegram group. This ensures you stay informed about the latest developments and can claim your tokens timely.

What is Bitcoin ETF Token?

Bitcoin ETF Token is a trending Ethereum-based token with a unique reward system intricately tied to the expected approval and launch of Bitcoin Spot ETFs.

The presale of $BTCETF has seen high investor traction, quickly raising over $1.8 million in just three weeks of launch, showing strong community support and investor trust.

At the time of writing, the token is priced at $0.0058 and is in the fifth presale stage. This early stage of the presale offers a chance for investors to buy in at a lower price, with an immediate upside potential toward the end of the presale.

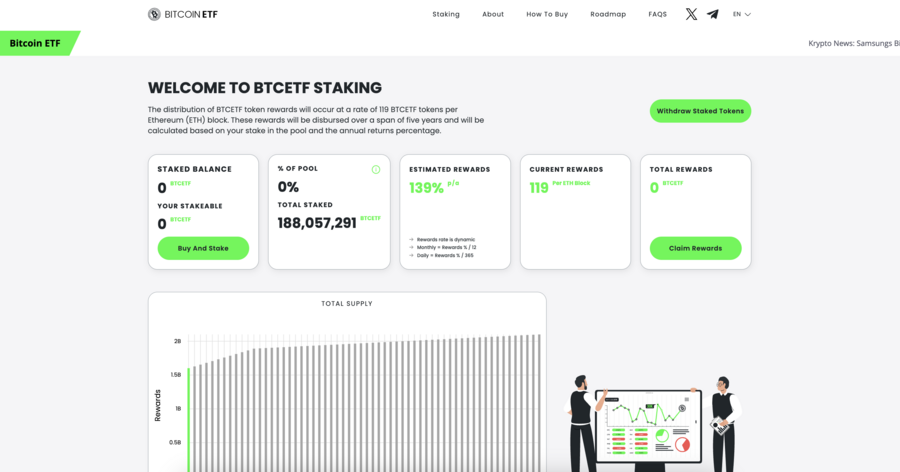

Staking Rewards and Long-Term Growth

A standout feature of Bitcoin ETF Token is its staking mechanism, which offers high Annual Percentage Yields (APY).

Early stakers can get an APY of over 135% at press time, highlighting the benefits for those participating early. However, investors should note that this APY will decrease as more tokens are staked throughout the presale.

To support long-term growth and stability, Bitcoin ETF Token has allocated 25% of its token supply for staking rewards, distributed over five years.

This structured approach to staking rewards is designed to offer significant returns to both early and long-term stakers, showing the project’s commitment to sustained development.

Investors can follow the project on its official social media accounts like on X (formerly Twitter) for the latest updates on the Bitcoin ETF Token and its reward structures.

Dynamic Token Burns for Sustainable Value Growth

The Bitcoin ETF Token introduces an innovative deflationary model to preserve and improve its value over time.

This model is specifically tailored to align with the evolving dynamics of Bitcoin ETFs, leveraging a unique approach to token supply management.

The Dynamic Token Burn System is at the core of BTCETF’s strategy, a mechanism designed to adaptively respond to significant developments in the Bitcoin ETF sector.

This system is programmed to decrease the total supply by 25% through a series of milestone burns, each triggered by specific events in the industry.

Milestones and Token Burn Process:

- BTCETF Trading Volume: The platform will initiate a 5% burn of the total supply when BTCETF reaches a trading volume of $100 million.

- Approval of First Bitcoin Spot ETF: The approval of the ‘first Bitcoin Spot ETF’ triggers an additional 5% burn of the existing supply.

- Launch of First Bitcoin Spot ETF: At the launch of this ETF, another 5% of the supply is burned.

- Assets Under Management: When the combined Assets Under Management of all Bitcoin ETFs exceed $1 billion, a further 5% supply burn is activated.

- Bitcoin Price Milestone: If Bitcoin’s price surpasses $100,000, an additional 5% burn in the total supply is implemented.

Transaction Tax Structure:

BTCETF has a transaction tax system with a 5% tax on all transactions within its ecosystem. This tax is an additional deflationary mechanism, contributing to the project’s overall economic model.

Following the completion of each milestone, BTCETF’s deflationary model adjusts by decreasing the transaction tax by 1%.

A Detailed Overview of Bitcoin ETF Token Presale And Tokenomics

The presale of $BTCETF is divided into ten stages, each offering 84 million tokens. This consistent supply distribution ensures fairness throughout the presale period.

BTCETF presale adopts a progressive pricing strategy, initially starting at $0.005 per token and gradually increasing to $0.0068 in the final stage.

This tiered pricing incentivizes early participation and aims to improve the token’s valuation over time. The tokens are priced at $0.0058 each at the ongoing fifth stage.

Bitcoin ETF Token presale targets a hard cap of $4,956,000, with over $1.8 million already raised in the early days of its launch, indicating strong investor interest.

Investors interested in participating in the presale can buy $BTCETF tokens using various cryptos, including ETH, USDT, BNB, MATIC, or through traditional card payments.

Token Allocation and Utility:

Bitcoin ETF Token offers a well-structured presale alongside community-focused tokenomics. Per the Bitcoin ETF whitepaper, $BTCETF’s total supply is capped at 2.1 billion tokens, with a strategic allocation plan to balance early investor incentives and long-term token stability.

- Presale Allocation: A significant portion, 40% (840 million tokens), is reserved for the presale phase for early adopters and investors.

- Exchange Liquidity Provision: 10% of the total token supply (210 million tokens) is set aside for exchange liquidity to ensure market stability and smooth trading post-listing.

- Staking Rewards and Token Burning: The remaining 50% of $BTCETF’s total supply is equally split between staking rewards and a dynamic token-burning mechanism. This approach serves dual purposes: rewarding the community through staking incentives and improving token scarcity and value over time through strategic burns.

Major Milestones and Prospects for Spot Bitcoin ETF Approval

The journey toward a Bitcoin ETF has been topsy-turvy since 2013, especially because of the lack of regulatory clarity on cryptos.

An ETF is an investment fund traded on stock exchanges, much like stocks. The charm of a Bitcoin ETF lies in its potential to provide investors with a regulated and simple way to invest in Bitcoin, thus bridging the gap between traditional finance and cryptos.

- Early Attempts: The Winklevoss twins, Cameron and Tyler, were the first to file the first Bitcoin ETF proposal in 2013. Despite their efforts, the U.S. SEC rejected their proposal in 2017, stating concerns over market manipulation and the nascent nature of the crypto market.

- Gradual Progress: Subsequent years saw numerous proposals from various entities, but the SEC’s stance remained cautious. The main concerns revolved around market maturity, liquidity, price manipulation, and the ability of an ETF to reflect the Bitcoin market accurately.

- Breakthrough and Continued Challenges: A major milestone was achieved in 2021 with the approval of several Bitcoin futures ETFs in the U.S. These ETFs, based on Bitcoin futures contracts, were seen as a step towards the approval of a spot Bitcoin ETF. However, the SEC has continued to delay or reject spot Bitcoin ETF proposals, stressing the need for more market surveillance and investor protection mechanisms.

Prospects of Spot Bitcoin ETF Approval:

Advocates argue that the crypto market has matured significantly, with improved liquidity, institutional participation, and regulatory compliance.

The increasing global acceptance of Bitcoin and the emergence of more sophisticated market surveillance tools increase the case for approval.

However, the SEC’s concerns about fraud and manipulation persist, making the timeline for approval uncertain.

Why Buy BTCETF During the Presale?

Investing in BTCETF during its presale offers several advantages for investors looking to enter promising new crypto presales early. Here’s why this phase is particularly attractive:

- Early Entry Benefits: Buying $BTCETF during the presale offers an advantageous entry point. Typically, presale prices are lower than those post-launch, providing early investors with the potential for high gains as the token gains traction and increases in value.

- Deflationary Tokenomics: $BTCETF has a deflationary model, meaning the total supply of tokens is designed to decrease over time. This decrease is often achieved through token burns, which can increase scarcity and potentially drive up the token’s value. For early investors, this means their holdings could appreciate as the supply diminishes.

- Staking Incentives: The project plans to offer staking rewards, a form of passive income for holding the tokens. Staking not only incentivizes long-term holding, which can stabilize the token’s price but also offers an additional revenue stream for investors.

- Strategic Launch and Tax Mechanisms: The launch strategy of $BTCETF, including a sell tax, aims to reduce the usual sell-off pressure seen with many new tokens. This tax can help maintain price stability and create a more balanced supply-demand dynamic, potentially leading to a gradual and sustained price increase.

What is BTCETF’s Potential – Bitcoin ETF Token Price Prediction?

The SEC’s prospective approval of a Spot Bitcoin ETF could be a defining moment in the crypto market. Large investments will likely be attracted by this development, potentially resulting in a surge in market valuation.

Given the circumstances, the $BTCETF coin is positioned strategically to profit from this situation. Investing in this space offers an exciting prospect for individuals looking to capitalize on the expanding crypto-ETF industry.

Moreover, linking token burns to regulatory milestones, like the SEC’s approval of a spot ETF, is still an unknown territory in the crypto world. This uniqueness makes it challenging to predict the future price of BTCETF accurately.

However, the forecast continues to be optimistic for $BTCETF. A major surge in its presale price is anticipated, possibly surpassing by 10x, particularly after completing the fifth and final burning milestone.

The $BTCETF coin also has a sales tax on transactions and offers staking rewards. These features are designed to limit the introduction of new BTCETF tokens into the market, potentially increasing the token’s value.

Additionally, reaching key milestones is expected to create excitement and positively impact the token’s worth.

Conclusion

The Bitcoin ETF Token is a promising new crypto, especially as we edge closer to launching its first spot Bitcoin ETF. The project is designed to offer attractive rewards to investors, aligning its growth with significant developments in the Bitcoin ETF sector.

A unique feature of Bitcoin ETF Token is its strategic approach to managing its token supply. The project has set a goal to reduce its total token supply by up to 25% by achieving five major milestones.

The presale has seen high investor traction, raising over $1.8 million within a few weeks. At press time, $BTCETF is available at $0.0058 per token.

References

- https://www.nytimes.com/2017/03/10/business/dealbook/winkelvoss-brothers-bid-to-create-a-bitcoin-etf-is-rejected.html

- https://www.financemagnates.com/institutional-forex/technology/the-growing-interest-in-cryptocurrency-from-institutional-investors/

- https://www.cnbc.com/2021/10/18/first-bitcoin-futures-etf-to-make-its-debut-on-the-nyse-tuesday-proshares-says.html

FAQs

What is Bitcoin ETF Token (BTCETF)?

Bitcoin ETF Token (BTCETF) is an Ethereum-based crypto that aligns its rewards and tokenomics with the developments in Bitcoin Spot ETFs. It features a unique deflationary model, including a dynamic token burn system and staking rewards designed to increase scarcity and value over time.

How to invest in BTCETF?

First, set up an ERC-20 compatible wallet like MetaMask. Purchase cryptocurrencies like ETH, USDT, BNB, or MATIC, which can be exchanged for BTCETF during its presale. Connect your wallet to the Bitcoin ETF Token presale website, select the desired quantity of BTCETF, and confirm the transaction. After the presale, claim your tokens from the site.