We’re sure you’ll agree when we say: traditionally, the insurance industry worldwide has been dominated by massive national brands and legacy product lines and age-old technology.

The change is already here and more changes are expected to disrupt the global insurance industry.

The rapid evolution of insurance technology or insurtech that’s making waves in the global insurance industry is surely here and we can see evidence of this everywhere.

All thanks to the insurtech innovations, the insurance products has moved from manual claim settlements to robotic process automation. Experts predict that insurtech will keep evolving as the mobile Internet unlocks new consumer behaviors and new business opportunities.

The BIG QUESTION:

“What InsurTech trends will continue to grow stronger in 2019 and beyond?”

We’ll show you the top three insurtech trends that will disrupt the global insurance industry in 2019 and beyond.

Trend #1: Wearable Tech will be the New Talk in Town

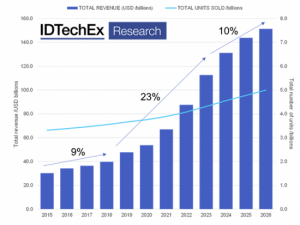

One of the most promising technology trends that are fast becoming a fad in the insurance industry is wearable tech. In fact, it is one trend that made headlines in 2017-18 and is expected to go even stronger in 2019 and beyond. In fact, the wearable tech market is likely to grow at CAGR of 23% annually to reach over $150bn by 2026.

Some of the world’s leading insurance companies including Cigna and United Healthcare are already leveraging wearable tech to offer usage-based insurance to consumers. These companies use wearable tech to obtain personalized data to decide on the insurance premium rate on the basis of lifestyle, driving habits, etc.

In a recent development, the largest and oldest North American life insurance companies, John Hancock announced that it will only sell interactive insurance policies based on the data gathered by wearable tech devices.

Given the immense potential of wearable technology, we are hopeful that a large number of insurers worldwide will start using this technology to provide usage-based insurance, decide policy premium rates, and incentivize policyholders for a healthy lifestyle and safe driving habits in 2019 and beyond.

Trend #2: Chatbot Technology will Take Centrestage in 2019

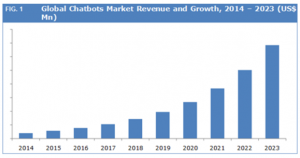

Let’s face it: Chatbot technology was a big win for the insurance industry in 2017-18. In fact, Global Trends Study 2017 reveals that an average of $124 million per insurer is invested in Chatbot technology in the insurance industry worldwide. Yet another report by Credence Research reveals that the popularity of chatbot technology will grow exponentially by 2023.

Given that chatbots can easily amass customers’ geographic and social data for personalized interactions, a large number of insurance companies are already investing in the technology to facilitate customize insurance coverage.

QBE, global insurance giant recently invested heavily in HyperScience, popular chatbot development, and machine learning firm. In a recent development, Allstate insurance introduced its flagship chatbot called (ABIE) Allstate Business Insurance Expert to provide policyholders with lower waiting time, seamless support and hassle-free claim settlements.

Looking at the ever-so-increasing popularity of the Chatbot technology worldwide, tech experts predict that the demand for Chatbot technology in 2019 will be 5 times more than what it was in 2017-18 in insurance industry worldwide.

Trend #3: RPA will Make Waves in the Insurance Sector in 2019

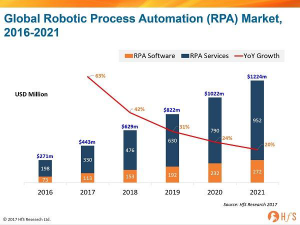

Robotic Process Automation (RPA) is yet another insurance technology trend that will make waves in 2019 and beyond. In fact, RPA is one of the most widely accepted technology trends worldwide. In 2017, the RPA market was worth 443 million USD and it is likely to reach 1224 million USD by the end of 2021.

A large number of insurance companies are shifting to Robotic Process Automation (RPA) in order to ensure superior automation of workflows and operations. RPA reduces the claim registration and processing time by at least 50%. In addition, RPA can help insurers take the hassles out of the otherwise complex insurance cancellation process.

Also, RPA can help insurance companies issue policies in less than 2 days. Typically, the process of policy issuance takes at least a week’s time. With so much on offer for insurance companies, it’s not rocket science to understand why robotic process automation is one of the insurance industry’s biggest technology-based opportunities for 2019 and beyond.

Over to You!

So there you have it the top three insurtech trends that will disrupt the insurance industry in 2019 and beyond. We are sure that the global insurance industry is going to witness tremendous technological disruption in the near future to optimize interactions, improve operational efficiency and decrease the compliance costs.