It was reported earlier this month that Intel will eliminate nearly 140 jobs after dropping three of its IoT-focused product lines. It followed news in June that last month’s news that Intel was discontinuing development of the company’s Galileo, Joule and Edison lines, originally developed to power a range of IoT-based devices and applications including wearables, smart speakers, and robotics.

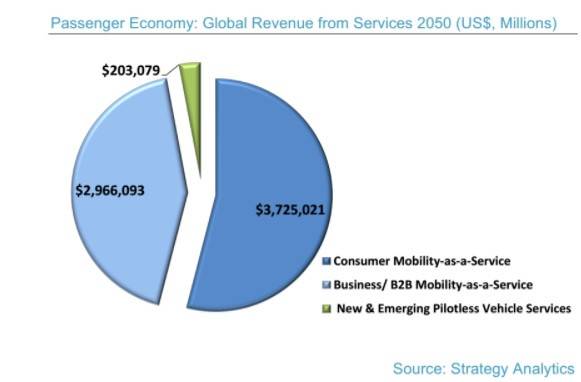

This news was preceded by a study in June by Intel into the yet-to-be-realized economic potential when today’s drivers become idle passengers. Coined the “Passenger Economy” by Intel and prepared by analyst firm Strategy Analytics, the study predicts an explosive economic trajectory growing from $800 billion in 2035 to $7 trillion by 2050. I participated in a webinar held by Intel to find out more.

What will we do in vehicles when we are not driving?

By the time we hit Level 5 vehicle autonomy and people are no longer driving themselves or others, Intel suggests we will shift to a model of Mobility-as-a-Service in effect a peripheral economy, where the car can contain and facilitate a range of functions. Mobility service providers will offer both on-demand and contract or subscription models that offer transportation as an amenity to their core retailing products or services. Over time service, application and content revenue generated by Mobility-as-a-Service will supplant the value of vehicle sales as core sources of shareholder value creation.

See also: Intel creates self-driving car consortium with Ericsson and Toyota

Sociologists like Ray Oldenburg have been promoting the theory of “‘a third place” since the 1980’s, places outside work where people can enjoy a good atmosphere and the company of others and Intel’s research suggests that this will be one of the uses of self-driving cars during the journey, with in-vehicle services in industries like hotel and hospitality, restaurant and dining, tourism and entertainment, healthcare, and service delivery of all kinds.

If we assume a conservative 300 million workers — less than 10 percent of all workers globally — drive to work an average of 30 minutes per day, this equates to over 60 billion hours per year of time spent driving that could be freed due to pilotless vehicles. This leaves their commuting time ripe for engagement by new services and new delivery models of current services. In-car services may include onboard beauty salons, touch-screen tablets for remote collaboration, fast-casual dining, remote vending, mobile health care clinics and treatment pods, and even platooning pod hotels. Media and content producers will develop custom content formats to match short and long travel times.

The report offers a range of future scenarios that suggest a future where life is easier and time in a vehicle is as purposeful as at home or work. Imagine if this was your day before a flight:

Mr. Schmidt has three meetings during the day and a 7:00 p.m. business flight. His Mobility-as-a-Service provider has scheduled a vehicle for him for the day. His ride arrives promptly at 6:55 a.m. to allow time for luggage storage. Leaving him at his first meeting, the AutoCab retrieves a preordered salad for lunch, picks up his suit at the cleaners, and picks up some toiletries for the trip at the pharmacy, and then returns to pick him up after his meeting. Mr. Schmidt completes his meetings using the travel time between meetings to pay bills, manage bank accounts and schedule a review of gift options for his wife’s birthday.

By 1:00 p.m., he has eaten the salad, watched a summary update of news personalized for his interests, and taken a 15-minute nap with the side glass digitally darkened. At 5:00 p.m., Mr. Schmidt arrives at the airport. As he leaves, he asks the vehicle to return some documents to his home before returning to the storage facility where AutoCab vehicles are in holding patterns for their next pickup or delivery.

It’s an interesting scenario as when you make note of all the different interactions that are carried out over the day. Each suggests supplementary and complementary roles carried out by others (let’s face it some like putting purchases in the car may by carried out by robots) and the car is not only a means to transport Mr. Schmidt but also a conduit to a range of other tasks.

B2B Mobility as a service

Mobility as a service will also gradually replace car ownership. This is significant when you consider that the average car currently sits idle 92% of the time. Doug Davis, Senior Vice President and General Manager, Automated Driving Group at Intel commented that ” large automakers are rapidly evolving into software companies and will become service providers for a fleet of networked vehicles.” Vehicles will be available for hire on-demand (potentially as part of a suite of subscription services) and can be substituted from a fleet, depending on the needs of the passenger.

Roger Lanctot, associate director of Strategy Analytics at Intel mentioned the significant shortage of commercial vehicle drivers in vehicles such as long-haul trucks, alluding to a future where rather than technology taking people’s jobs it would fill the gaps. The report further suggests that transportation companies, regardless of the size of their travel distances, should plan for the re-training of their workforces. They may, for example, become customer service professionals who can sell and market services and related goods and offerings or supply chain experts.

Lanctot also commented, “It’s possible that we’ll see a whole new class of vehicles, like autonomous bicycles, RV’s and autonomous houses, concepts that a just a twinkle in people eyes.”

A gradual progression is essential

Intel notes that the transition to passengers being comfortable enough to take their eyes off the road will take some time, stating:

“For this vision of the Passenger Economy to truly arrive, consumers’ perceptions of autonomous vehicles will need to evolve to where they believe and embrace as fact that these vehicles are 100%t safe. To enable this, technology vendors will need to complete billions of miles of testing and deliver a string of commercial solutions that prove vehicle safety and reliability.” They also note that there will be some people unwilling to give up driving altogether.

Intel is just one of many companies that are leveraging a future heavily invested in autonomous transport. It’s becoming an increasingly crowded space as technologists compete to be first to the line with road-ready vehicles once level 3-5 cars become more mainstream. It may be a while yet until we see can sit in our virtual office, but there’s no shortage of technologists waiting with bated breath.

Photographs of future vehicles by Ideo